Finding that Shopify has stopped payments on your store and placed payment holds without warning can be a challenging and frustrating experience for any Shopify merchant. When payments are placed on hold, it can disrupt sales, reduce consumer trust and have a wider effect on your business.

It’s important to understand the reasons behind payment on hold on Spotify in order to resolve existing holds, or prevent future ones.

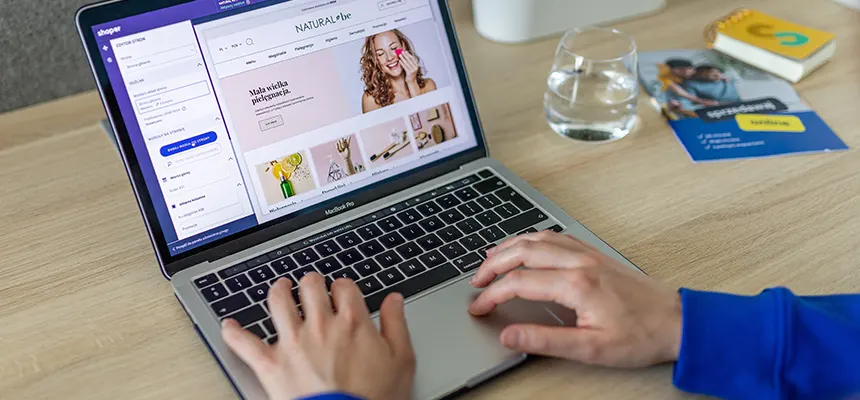

There are more than 1.4 million sellers using Shopify as their choice of ecommerce platform. Shopify closely monitors all payments that are processed through their payment system to promote the security and integrity of transactions. By understanding the rules of Shopify payments, sellers can efficiently navigate the process and proactive measures can also be taken to prevent or resolve payment holds.

One common reason for payment holds is the detection of potentially fraudulent activities. Shopify employs robust fraud detection systems, which can analyse transaction patterns, buyer behaviour, and other indicators. These features make it possible to identify suspicious transactions. If a payment is flagged as potentially fraudulent, Shopify may place it on hold to conduct further verification.

Another factor that may lead to Spotify funds on hold is order disputes or chargebacks initiated by customers. Chargebacks occur when customers dispute a transaction directly with their bank via Visa or Mastercard. Shopify protects both buyers and sellers by placing payments on hold until the dispute is resolved or the chargeback is reversed.

Besides this, certain industries or products may raise red flags and trigger payment holds. High-risk industries may experience more frequent Spotify payment security holds due to regulatory requirements or industry-specific risk factors. Such industries may include adult products, CBD merchant, gambling, and certain digital services.

Furthermore, new or high-volume merchants may also be challenged by payment processing holds on Spotify as part of the platform’s risk management measures. Shopify assesses and keeps track of the activity of new or rapidly growing businesses. This action is carried out to ensure compliance with their terms of service and mitigate potential risks.

Understanding these reasons behind Shopify payment holds can help you prepare yourself and implement necessary safeguards. These steps help them take proactive steps to prevent and resolve payment holds.

Shopify may hold your money depending on numerous factors such as the amount, level of risk, and amount of time it takes to resolve the chargeback. Shopify may hold your funds for 30 to 120 days. Be that as it may, the hold can sometimes take up to six months. This may be due to the involvement of third parties, including banks and credit card companies.

Are you faced with a Shopify payment delay but you don’t know what to do? If so, the following steps can be quite effective in resolving such a challenge. Keep reading!

To effectively resolve a Spotify payment authorization hold, the crucial first step is to understand the nature of the hold. Acquaint yourself with the specific details of the hold. This may include the reason provided by Shopify, the status of the hold and any additional information required. Understanding this will help you develop an appropriate strategy for resolution.

Oftentimes, resolving a payment hold on Shopify requires submitting additional documentation or information. This helps in verifying the legitimacy of the transaction, including invoices, proof of delivery, or customer communication. Review the hold notification thoroughly and gather the required documents. This will provide a prompt and comprehensive response to Shopify.

You may be unsure about the reason behind the Spotify pending payment or require further guidance. Then, reaching out to Shopify’s support team is essential. Contact their support channels to explain the situation in detail via live chat, email, or phone. Provide any relevant information or documentation requested by the support team. You should also maintain open communication until the hold is resolved.

In some cases, payment holds occur due to customer disputes or chargebacks. Then, it is crucial to address these issues promptly by communicating with the customer to understand the reason for the dispute and try to resolve it amicably. You may also provide evidence, including order details, tracking information, or proof of delivery. This will support your case and request a chargeback reversal.

Preventing payment holds on Shopify is crucial for maintaining smooth cash flow and uninterrupted business operations. It is imperative for sellers to implement proactive measures and best practices to minimize the risk of payment holds while ensuring a seamless payment experience for their customers. This section will explore three essential strategies to prevent Shopify payment holds effectively.

Fraudulent transactions are a significant factor that can trigger payment holds on Shopify. If you wish to prevent payment holds resulting from fraudulent activities, it is essential to implement robust fraud detection and prevention measures. This may include

Inaccurate inventory management or product information can result in payment holds on Shopify. Customers may place orders for products that are no longer available or experience discrepancies between the listed product and the delivered item. In this case, it is possible to initiate disputes or chargebacks. To prevent such scenarios, it is crucial to take certain steps including:

Choosing a reliable payment provider and gateway is crucial for preventing payment holds on Shopify. Opt for reputable and trusted payment service providers that offer robust fraud protection mechanisms, as well as comprehensive transaction monitoring. These providers often have advanced systems in place to detect and prevent fraudulent activities. This reduces the likelihood of payment holds. Ensure that you research thoroughly and select a payment provider that aligns with your business needs to facilitate secure and seamless payment processing.

Resolving Shopify payment issues requires an effective and proactive approach, which is quite straightforward. This Shopify payment guide has explained the importance of understanding the reasons behind payment holds. As a seller, you should also provide necessary documentations while contacting Shopify support. Taking the essential steps listed above will enable smoother payment experience, maintain cash flow, and build trusts with customers on the platform.