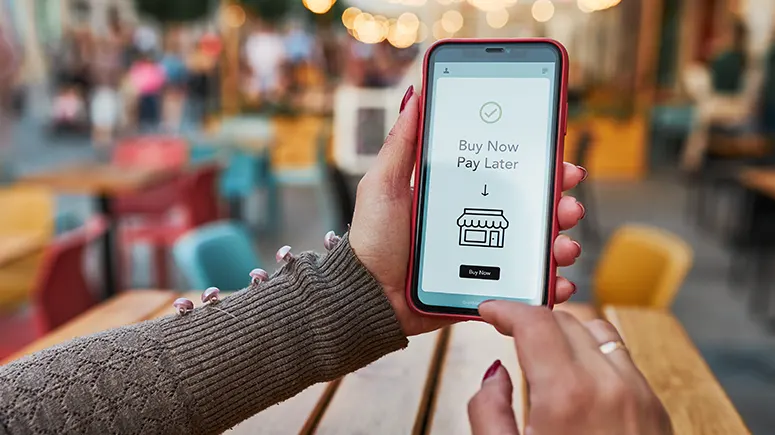

Buy Now, Pay Later (BNPL) payment providers offer a convenient and pocket-friendly way for customers to pay for their purchases. Customers can spread the cost of their purchase over an agreed period of time without having to worry about additional costs or interest rates, typically charged by credit cards.

BNPL payment options are becoming increasingly popular with shoppers as they provide flexibility. What might be a steep upfront cost for certain items can be spread out over a few months instead. This makes it easier to budget and even affords customers the opportunity to purchase something they may not normally buy due to financial restrictions.

From a business perspective, BNPL payment providers are beneficial as they increase customer engagement, attract more customers, encourage brand loyalty and prevent card abandons, later down the sales funnel.

BNPL payments are essentially payment plans that customers can use to spread out their costs. Customers will make a purchase, selecting the BNPL option at checkout, and then pay it off over an agreed period of time (generally four), usually in equal instalments.

The payments are typically taken directly from the customer’s bank account on a pre-agreed day each month.

The provider may usually offer customers additional benefits such as reward points, discounts or promotions for using the BNPL service.

At the end of the payment period, customers have paid off their purchase in full and own the item outright.

The biggest difference from conventional equated monthly instalments offered by credit cards is that BNPL providers do not charge steep interest or additional fees.

This makes it a more attractive option for customers who are looking to purchase items without the worry of hefty interest charges.

As merchants, it’s important to keep up with the rapidly changing payment landscape and provide customers with more options. Buy now, pay later (BNPL) payment providers are an increasingly popular payment solution that can offer your customers a variety of benefits.

In addition, BNPL payments offer shoppers more flexibility when it comes to paying off their purchases. Customers can pay their balance in instalments over a period of time, allowing them to spread out their payments in a way that best fits their budget.

Also, the modern customer is increasingly concerned with their credit score and the cost of debt. BNPL payments offer shoppers an alternative way to pay that doesn’t involve taking on debt which can be taxing on one’s credit history if payments are not paid on time.

Offering BNPL payments can also increase sales, as customers may be more likely to purchase items when they know that they don’t have to pay the full cost upfront. This can be especially beneficial for merchants selling high-ticket items.

Offering BNPL payments as a payment option can also help merchants build customer loyalty. Customers appreciate the convenience and flexibility that comes with BNPL payments, and they may be more likely to come back and shop again if they had a good experience.

BNPL payment providers now command a loyal and growing customer base. So, by offering BNPL payments, merchants can tap into this customer base and acquire new customers who may not have otherwise considered their business.

For instance, Forbes shows that there was a 600% rise in the number of Gen Z shoppers using BNPL services during the Covid-19 pandemic, which further demonstrates the popularity of BNPL payments.

Repeat customers also benefit from BNPL payments, as the checkouts are faster and more seamless. This is because customers don’t need to enter their card details each time they make a purchase.

This adds to the overall convenience of the shopping experience, which can help merchants build customer loyalty and increase their sales.

While there are many potential benefits to offering BNPL payments, there are also some drawbacks that merchants should be aware of.

BNPL payment providers have a more stringent vetting process for merchants compared to more traditional payment providers, which translates into poor acceptance rates.

If you function in a high risk industry, you may find it difficult to obtain merchant account approvals for BNPL payments.

It is important to note that offering BNPL payments can come with higher transaction fees than other payment options.

Since BNPL payment providers are relatively new, the integrations may not always be as seamless and smooth as merchants would like.

This can be especially true if you are using a third-party integration service to connect your ecommerce store with BNPL payment providers.

Apart from a couple of big BNPL brands like Klarna and Afterpay, there are many other small BNPL payment providers that may not always be compatible with your store.

BNPL fraud is a real concern and merchants should be aware of the risks they face when accepting BNPL payments.

Merchants must ensure that they have appropriate fraud prevention measures in place to protect their business from fraudulent transactions.

According to RFI Global, more than 17-million UK consumers have already used a BNPL payment method. These numbers are all set to rise, as BNPL popularity continues to grow in the UK.

So here’s a roundup of some of the top BNPL providers in the market currently.

This Swedish fintech company is one of the biggest names in BNPL payments in Europe currently. Their recent expansion into Italy, France and Spain means that they are now present in more than 18 countries.

This Manchester-based fintech company provides flexible payment options for customers based on affordability. They offer interest-free credit even for students who may not have access to traditional credit options.

With the option to stretch and spread the payments beyond one’s credit limit, Laybuy is a great BNPL payment provider for customers who may not have the funds at one go.

It also assumes complete control of the credit transaction and provides an easy-to-use payment portal.

It is estimated that almost 63% of UK retailers are not offering BNPL payment options to their customers.

This means losing out on a potentially lucrative customer base. As discussed above, offering BNPL payments can provide merchants with multiple benefits, including smoother checkouts, quicker approval process, and higher conversion rate.

We can help you find the best BNPL provider for your business, to ensure you make the most of this payment option. Get in touch with us today to learn more.